Foreign Direct Investment (FDI) Laws in Nepal

1. Introduction:

Foreign Direct Investment is net flow of investment from one country to another. Foreign Direct Investment (hereinafter FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country.

2. Existing Governing Laws:

a. Foreign Investment and Transfer of Technology Act 2019 (FITTA):

It is fundamental laws for foreign investment in Nepal and is subject to various foreign investment and technology transfer, joint ventures as such.

b. Foreign Investment and Technology Transfer Regulation, 2021 :

It majorly states about the broad procedural aspects of foreign investment and technology transfer rules and regulations.

c. Industrial Enterprises Act, 2020 (IEA),Company Act 2006:

It provides a clear legal proceedings for foreign investments in Nepal.

d. Public Private Partnership and Investment Act, 2019:

Public service partnership is highlighted by the act along with manufacturing sectors in Nepal

e. Company Act, 2006:

Company act provides the general process of establishing the company and procedural aspects for running the company and foreign entities in Nepal.

3. Governing Authorities:

1. Department of Industries (DOI)

Approval for investments up to NPR 6 Billion

2. Investment Board of Nepal (IBN)

Approval for investments of more than 6 Billion

3. Nepal Rastra Bank (NRB)

Approval to bring and repatriate in foreign investment amount into Nepal

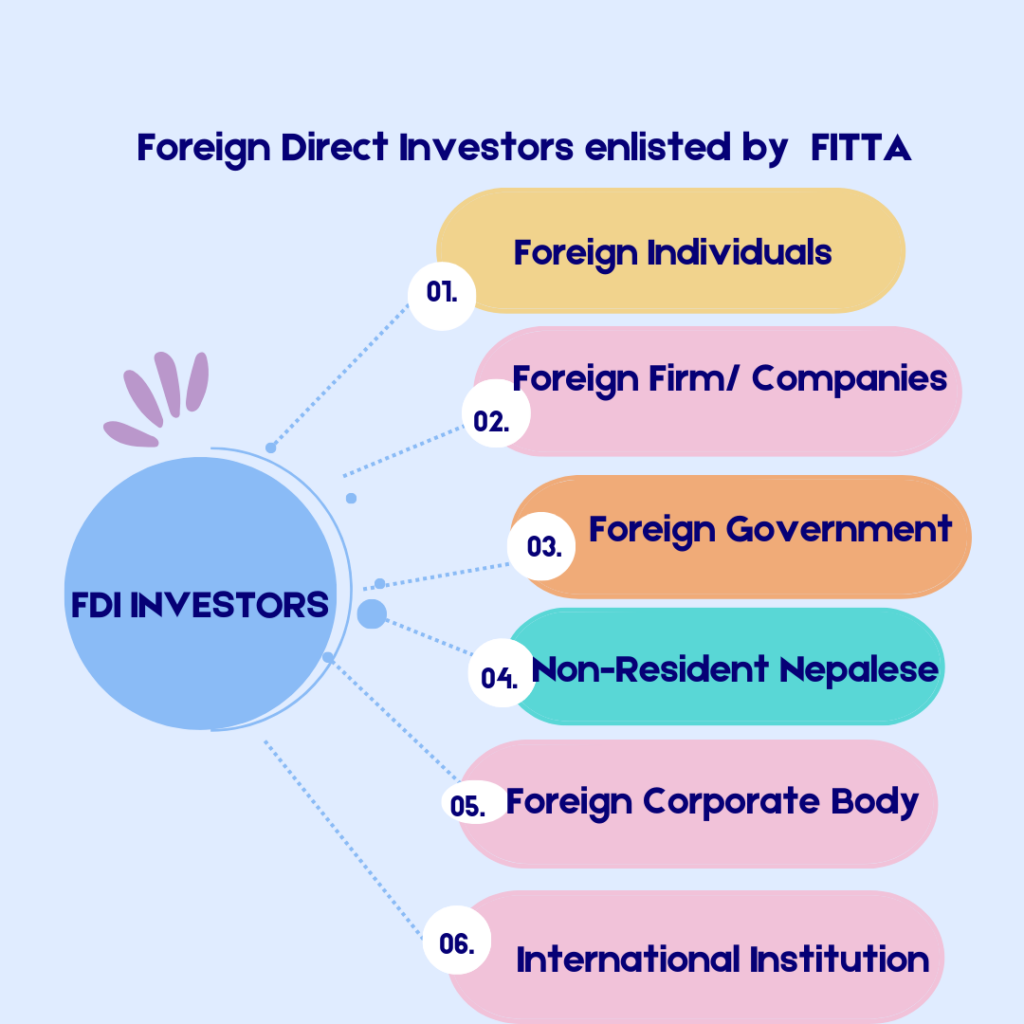

4. Foreign Investors for Foreign Investment in Nepal:

FITTA of Nepal recognizes the following persons and foreign entities to be investors for foreign investment in Nepal:

5. Permissibility Requirement for FDI :

For the permissibility of foreign investments in an industry, following two things are fundamental:

- The proposed business activity should not fall within the restricted list prescribed by Foreign Investment and Technology Transfer Act, 2075 (FITTA).

- The proposed business activity should have been classified as an “Industry” under Industrial Enterprises Act, 2076

5.1. Industries Restricted for Foreign Investment:

Following are the industries/ Business restricted for Foreign Investment:

1. Poultry farming, fisheries, bee-keeping, fruits, vegetables, oil seeds, pulse seeds, milk industry and other sectors of primary agro-production.

2. Cottage and small industries

3. Personal service business (hair cutting, tailoring, driving etc.)

4. Industries manufacturing arms, ammunition, bullets and shell, gunpowder or explosives, and nuclear, biological and chemical (N.B.C.) weapons; industries producing atomic energy and radio-active materials.

5. Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, remittance service

6. Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay

7. Business of mass communication media (newspaper, radio, television and online news) and motion picture of national language

8. Management, account, engineering, legal consultancy service and language training, music training, computer training

9. Consultancy services having foreign investment of more than fifty-one percent

5.2 Permitted sectors for foreign investment / Foreign business in Nepal:

1. Manufacturing Industry

Industries manufacturing products by using processing raw materials such as cosmetic products, oil industries as such

2. Infrastructure Industry:

Road, Bridge, tunnel, ropeway, railway, monorail, airport, business complex, irrigation infrastructure.

3. Information, communication and Technology Industry:

Internet service provider, software companies, data center, telecom, business process outsourcing.

4. Energy Based Industry:

Hydropower, oil and fuel, gas, electricity transmission distributing line, biomass, solar so on

5. Agriculture and Forest Industry:

Furniture industry, cold storage, paper production, fruit farming and processing, milk and dairy products.

6. Tourism Industry:

Resort, bar, restaurants, hotels, travel agency, tour operator, healing center casino, mountaineering, rafting, construction and operation of cable car, cruise, water entertainment sector.

7. Service Oriented Industry:

Investment companies, e-commerce, construction business, hospitals, nursing homes, clinic and polyclinic, therapy clinic etc

8. Mines and Minerals Industry:

Industries producing natural gas, fuel and petroleum products.

Note:

Foreign investors may make investment individually or jointly and when making investment through joint venture, joint venture agreement to be submitted to DOI.

6. Nature of Foreign Investment allowed in Nepal:

FITTA has explained different kind of investment in Nepal as Foreign Investment is allowed as equity investment, technology transfer, asset purchase, lease financing, branch company, loan investment.

Below chart shows the forms of foreign investment allowed as per law of Nepal.

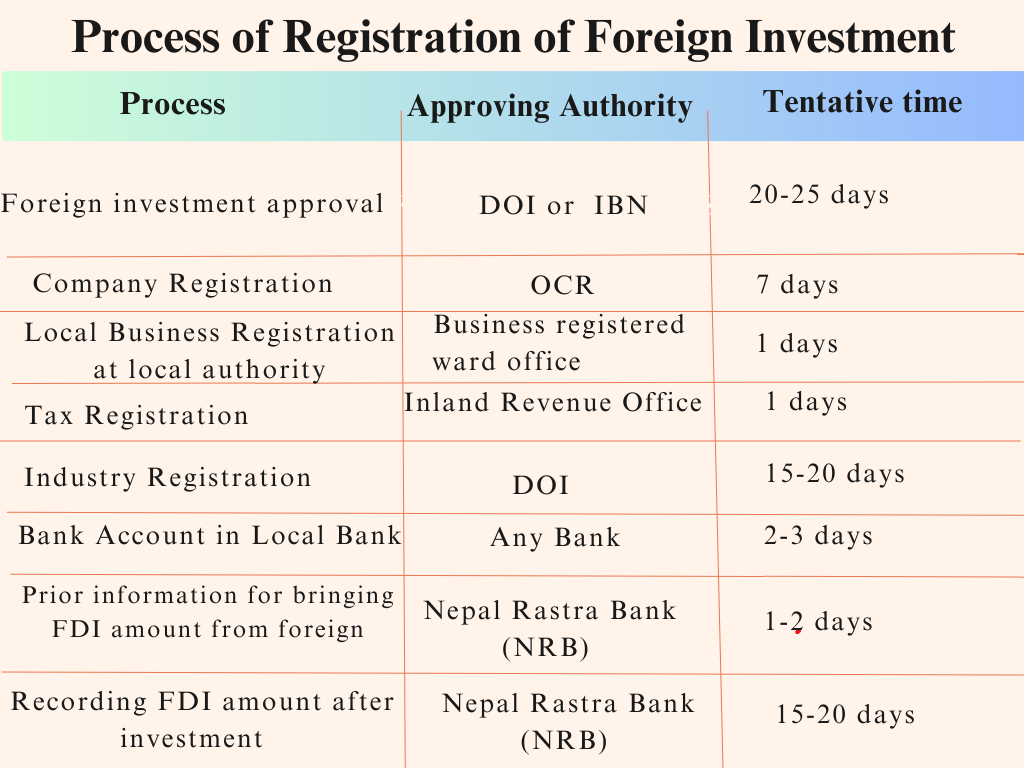

7. Foreign Investment Company Registration Process in Nepal: Process of Registration of Foreign Business in Nepal

7.1 General Process of establishment of Foreign Business in Nepal is listed below:

Step 01 : Making an Application for approval to DOI/ IBN

Step 02: Company Registration in OCR

Step 03: Registration of Business in Ward Office

Step 04: Tax Registration in Inland Revenue Office

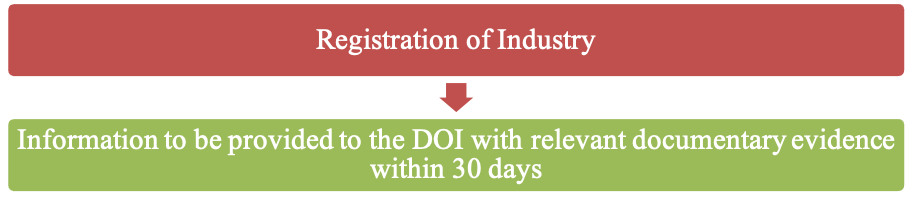

Step 05: Registration of Industry at DOI

Step 06 : Giving information to the Nepal Rastra Bank

Step 07 : Obtaining Approval from NRB to bring foreign Investment

7.2. Process of establishment of foreign investment business in Nepal with required process and timeline is given in the table below:

8. Required Documents for Foreign Investment:

| S.No. | Documents | No.of Copies |

| 1. | Project Report | 3 |

| 2. | Joint Venture Agreement (JVA), in case of more than one investor | 3 |

| 3. | Citizenship Certificate of Local party or Certificate of Incorporation, including Memorandum of Association and Articles of Association if the local party is a company | 1 |

| 4. | Copy of passport of foreign party or certificate of incorporation including MOA and AOA if the party is a company | 1 |

| 5. | Corporate resolution of the foreign investor to invest in Nepal | |

| 6. | Company profile of the foreign party/ Bio-data | 1 |

| 7. | Documents stating the source of investment and time schedule of investment | |

| 8. | Financial Credibility Certificate (FCC) of the foreign investor provided by a home country bank or domiciled country bank | 1 |

| 9. | Commitment letter by investor stating that foreign investors shall not repatriate investment till one year | |

| 10. | Authority letter from the concerned companies or individuals to carry out any necessary work on their behalf, if applicable |

9. Process of Foreign Investment in an Existing Industry by Share Transfer:

Documents Required:

| S.No. | Document | No. of Copies |

| 1. | Request from the share transferor | |

| 2. | Request from the share transferee | |

| 3. | Share transfer Agreement | 3 |

| 4. | Copy of minutes of board meeting of local company regarding inclusion of foreign investor into the company | 1 |

| 5. | Copy of minutes of Board Meeting, Certificate of Incorporation and company profile of the foreign party if the party is a company | 1 |

| 6. | Copy of passport and Bio-data of foreign party, if party is an individual | 1 |

| 7. | Financial Credibility Certificate of the foreign Investor provided by a bank | 1 |

| 8. | Current Share Holder’s List as certified by the Company Registrar’s Office | 1 |

| 9. | Auditor’s Report | 1 |

| 10. | Tax clearance certificate | 1 |

| 11. | Authority letter(s) from the companies or individuals to carry out any necessary work on their behalf, if applicable |

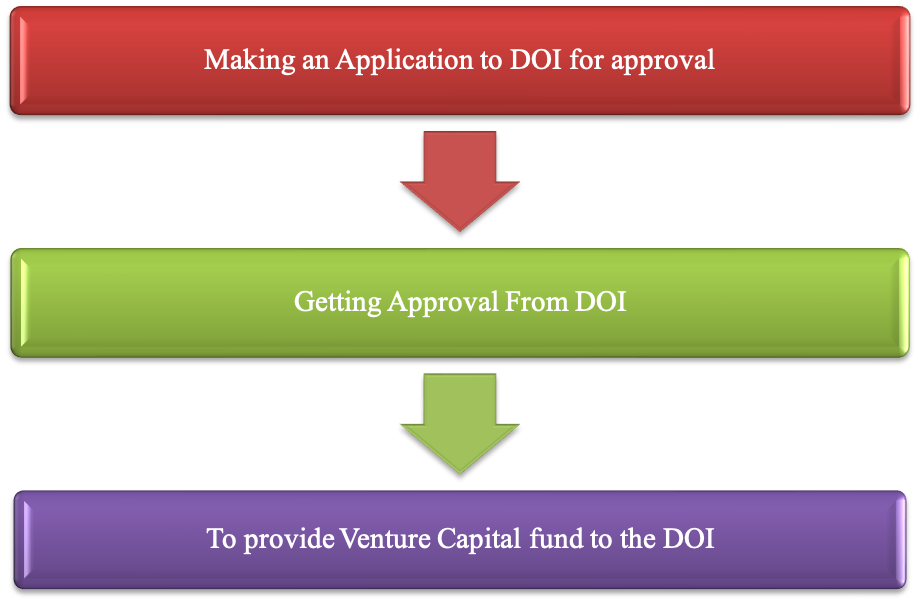

10. Process of Foreign Investment by establishing venture capital fund:

Documents Required:

| S.No. | Documents | No. of Copies |

| 1. | Application | 1 |

| 2. | Technology Transfer Agreement | 3 |

| 3. | Citizenship certificate of local party or Certificate of Incorporation, including Memorandum of Association and Articles of Association, if local party is a company | 1 |

| 4. | Copy of passport of foreign party/or Certificate of Incorporation, including Memorandum of Association and Articles of Association, if the party is a company | 1 |

| 5. | Bio-data / Company profile of the foreign party | 1 |

| 6. | Industry Registration Certificate | 1 |

| 7. | Copy of the minutes of the Board of the recipient company | 1 |

| 8. | Authority letter from the concerned companies or individuals to carry out any necessary work on their behalf, if applicable | 1 |

11. Required document of Loan Investment by foreign investors in an Existing Nepalese Industry:

Documents required:

| S.No. | Documents | No. of Copies |

| 1. | Loan Agreement | 3 |

| 2. | Certificate of Incorporation, including Memorandum of Association and Articles of Association of the lending agency | 1 |

| 3. | Certificate of Incorporation, including Memorandum of Association and Articles of Association of the lending agency | 1 |

| 4. | Industry Registration Certificate | 1 |

| 5. | Copy of the minute of the Board of the recipient company regarding the loan to be acquired | 1 |

| 6. | Authority letter from the concerned companies or individuals to carry out any necessary work on their behalf, if applicable |

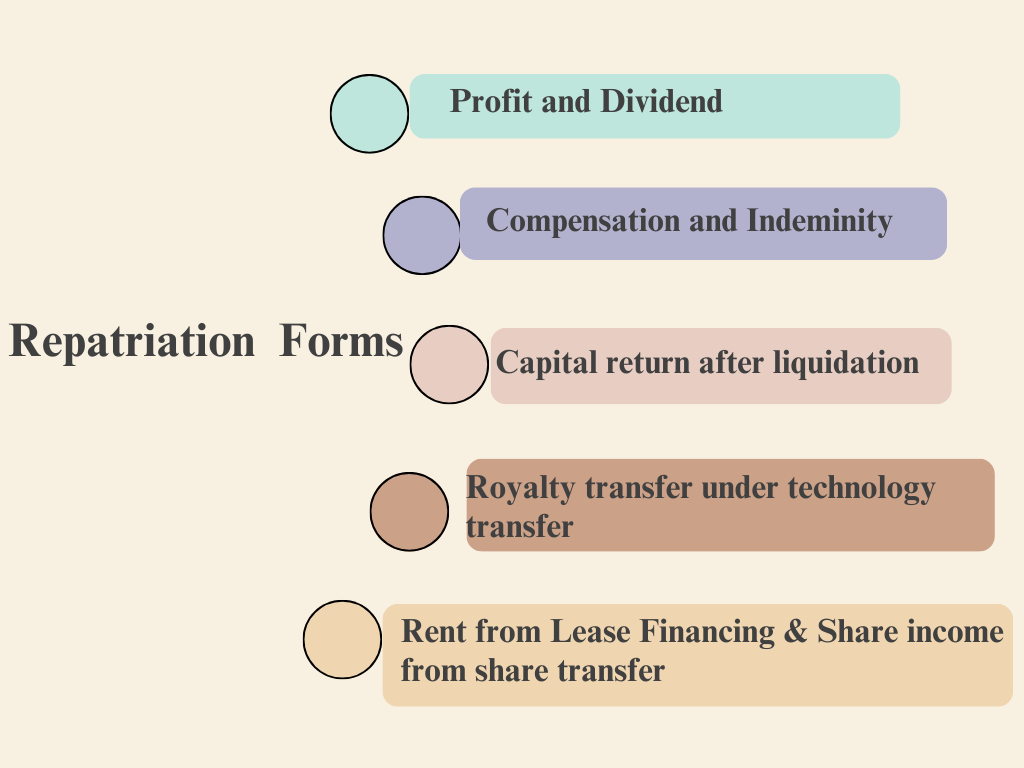

12. Repatriation and Returns of Foreign Investment by Investors:

FITTA has mentioned the different repatriation rights in convertible currency of foreign investors after the approval of Nepal Rastriya Bank (NRB) after fulfilling all the regulatory approvals and liabilities of taxes. Foreign Investors can repatriate profit and dividends, Royalties under technology transfer and agreements, returns of capital after fulfilling all the process of liquidation, compensations, Lease Rent, amount of share transfers.

Foreign Investors are not allowed to repatriate the amount within the first year of their investment in Nepal. Following forms of investment that can be repatriated:

Repatriation of foreign investment and its profit

Approval for repatriation is needed from DOI /IBN and NRB and takes time period of more than 15 days for the approvals.

Documents Required for approval of Repatriation of Foreign investments and returns of income, profits of foreign companies established in Nepal:

Documents required for repatriation from DOI/IBN:

- Resolution of board meeting for repatriation and its proceedings.

- Shareholders and BOD register certified by OCR

- Audit report and Audited financial statments

- Tax Clearance

- FDI approval

- Foreign investment certificate issued by bank

- Share purchase agreement, share sale deed with board resolution

- Under technology transfer agreement, royalty amount state in audit report

13. Visa Facilities for foreign Investors in Nepal Under FITTA 2019:

| Types of Visa | Provision | Tenure |

| Non-Tourist Visa | Foreign investors for study, research or survey of foreign investment | Up to Six month |

| Business Visa | Foreign investors or authorized representative of foreign company and their family members | Until they will be employed as authorized representative for the company |

| Business Visa | Two authorized representative and their family members of foreign investors who invests 25% of total investment | Until they will be employed as authorized representative for the company |

| Non-Tourist visa and work permit | Foreign Experts, technical or managerial employee working for foreign investment company |

14. Dispute Settlement of Foreign Investment in Nepal:

Dispute is settled amicably before Department of Industries within 45 days if not only parties can proceed settlement of dispute through Arbitration. If the agreement and transaction documents are silent about the dispute settlement mechanism than Nepalese law shall be governing with UNICITRAL rules of arbitration and seat of arbitration will be in Kathmandu.

Please contact us today itself if you are in search of Labor lawyer in Nepal on +9779841933745 or email info@lawinpartners.com

Disclaimer: All contains available here are for general information purposes. A proper legal solution always depends on your particular circumstances thus seek advice from an attorney who can provide assurances of the information contained herein and interpretation of it. All liability with respect to actions taken on the basis of the site’s information is hereby expressly disclaimed.