Company Registration Process in Nepal

Background

Business can be registered in different authority and operated in Nepal. Local business can be registered at local government ward and municipality offices and limited liabilities companies are mostly registered in office of company register and operated in Nepal.

A company is a separate legal entity formed by a group of individuals to operate a business, commercial or industrial enterprise created by a legal process, having a legal right, incurring liabilities with perpetual succession. The company Registration process in Nepal is governed by Companies Act, 2063 (hereinafter Act). In Nepal, the Office of Company Registrar (OCR) is the authority to regulate the process of registration of a company.

1. Existing law for registration of company in Nepal

Companies Act, 2006 (2063) is the law governing the process of registration of Company in Nepal.

2. Governing Authority

The office of Company Registrar (“OCR”) is the governing authority for the registration of Company in Nepal.

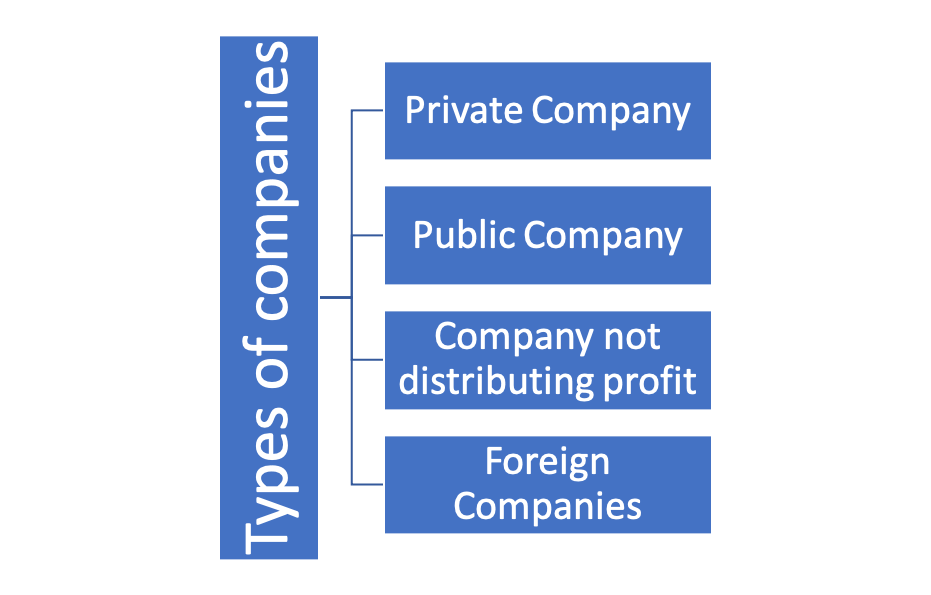

3. Types of Companies:

The Act addresses the registration process of the following types of companies registration in Nepal.

Fig: Types of Company

4. Private Company Registration Process in Nepal:

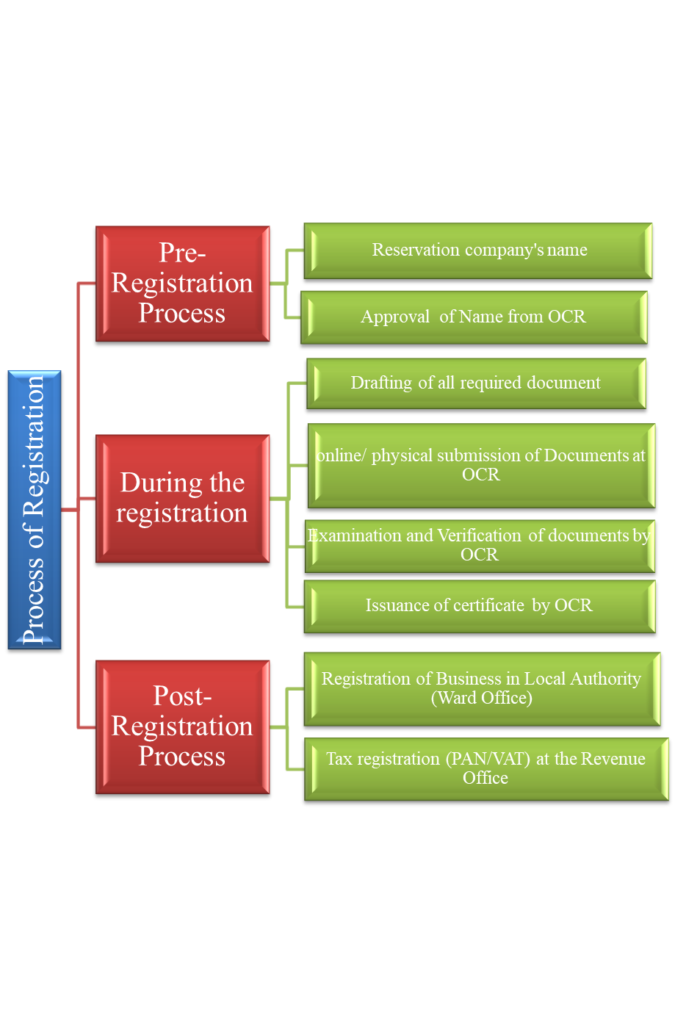

Below is the step of company registration process in Nepal

Step 01: Reservation company’s name

Step 02: Approval of Name from OCR

Step 03: online/physical submission of Documents at OCR

Step 04: Examination and Verification of documents by OCR

Step 05: Issuance of certificate by OCR

Step 06: Registration of Business in Local Authority (Ward Office)

Step 07: Tax registration (PAN/VAT) at the Revenue Office

Fig: Process of Company Registration in Nepal

5. Documents Required for registration of Company in Office of Company Registar Office

Below mentioned are the documents required for the private company registration process in Nepal:

| S.No. | Documents Required | No. of Copies |

| 1. | Application for the Registration | 1 |

| 2. | Memorandum of Association | 2 |

| 3. | Article of Association | 2 |

| 4. | Citizenship certificate in case of Nepali promoter/ passport in case of foreign promoter | 1 |

| 5. | Consensus Agreement (if any) | 1 |

| 6. | Permission obtained to invest by foreign promoters | |

| 7. | Copy of certificate of registration and other registration documents (memorandum of association, articles of association) if the shareholder is company | 1 |

| 8. | Corporate resolution of the shareholder if the shareholder is a company | 1 |

| 9. | Copy of prior approval of the DOI in case the shareholder is a foreign investor | 1 |

6. Post -Registration process of Company in Nepal

Documents required for registration of business in local authority(Ward office)

- Citizenship of the shareholders

- Rental Agreement

- Company Registration Certificate

Documents required for Tax Registration (VAT/PAN) in Inland Revenue Office:

- Citizenship of the shareholders

- Company Registration Certificate

- Registration of Business Certificate

7. Government Fee as per the capital:

The government Fee for the private company registration process in Nepal is mentioned below:

| S.No. | Amount of Authorized Capital | Registration Fee (Rs) |

| 1. | Up to 1,00,000/- | 1,000/- |

| 2. | 1,00,001 to 5,00,000/- | 4,500/- |

| 3. | 5,00,001 to 25,00,000/- | 9,500/- |

| 4. | 25,00,001 to 1,00,00,000/- | 16,000/- |

| 5. | 1,00,00,001 to 2,00,00,000/- | 19,000/- |

| 6. | 2,00,00,001 to 3,00,00,000/- | 22,000/- |

| 7. | 3,00,00,001 to 4,00,00,000/- | 25,000/- |

| 8. | 4,00,00,001 to 5,00,00,000/- | 28,000/- |

| 9. | 5,00,00,001 to 6,00,00,000/- | 31,000/- |

| 10. | 6,00,00,001 to 7,00,00,000/- | 34,000/- |

| 11. | 7,00,00,001 to 8,00,00,000/- | 37,000/- |

| 12. | 8,00,00,001 to 9,00,00,000/- | 40,000/- |

| 13. | 9,00,00,001 to 10,00,00,000/- | 43,000/- |

| 14. | 10,00,00,000/- | 30 for each 1,00,000/- |

8. Timeline for Registration of Company

It will require 7 to 10 days for incorporation of company in Nepal.

9. Fee/Tax Required for Company Registration

As per the current Budget of Nepal fee/tax has been waived for registration of company in Nepal. Folliowing fee/tax has to be during the registration of company in Nepal is as mentioned:

| S.N | Particulars | Government Fee |

| 1. | If company is of Foreign Investors amount must be deposited at DOI | 2 corer NPR (Approx 20,000 USD) |

| 2. | Business Registration in Ward Office | 5000 to 1500 NPR (Approx 38 to 115 USD) |

| 3. | House Rent Tax | 10% of house rent amount per month |

10. Post registration compliance

Following are the post registration compliances that a company should do after registration of company in Nepal:

Receiving the specific license from concerned department (if necessary). Kindly go through para 11 of this article.

Submission of 3 months compliance document before OCR,

Recording of investment at NRB (in case of FDI Company)

Submit Annual Compliance Document at OCR,

Compliance with Companies Act, Labor Act, Tax Law and other applicable law of Nepal during the operation of the local subsidiary company.

11. Specific business approval

There are some nature of business which need additional approval from the concerned department prescribed by the law even after incorporation of company before their operation.

| S.N. | Nature of Business | Institution to grant License/Approval |

|---|---|---|

| 1 | Colleges | Affiliated University |

| 2 | Insurance Company | Insurance Board |

| 3 | Bank and Financial Institution | Nepal Rastra Bank |

| 4 | Hydro Power | Electricity Development Board |

| 5 | Travels and Trek | Ministry of Tourism, Culture and Civil Aviation |

| 6 | Food Industries | Department of Food Technology and Quality Control |

| 7 | Business related to telecommunication | Nepal Telecommunication Authority |

IMPORTANT NOTE:

Annual filing of company details must be updated to office of company register (OCR) each year.

Disclaimer: All contains available here are for general information purposes. A proper legal solution always depends on your particular circumstances thus seek advice from an attorney who can provide assurances of the information contained herein and interpretation of it. All liability with respect to actions taken on the basis of the site’s information is hereby expressly disclaimed.