Liaison Office Registration of Foreign Company in Nepal

This Article on Liaison office explicitly explains and makes reader clear about the legal proceedings/process, required documents, time requirement for registration process and authorities on establishment of liaison office in Nepal.

1. Introduction:

Liaison office also known as contact office or contact point for foreign company in Nepal. Liaison office coordinate in establishing relationship with local business or parties where it is established.

2. Governing Laws:

Existing governing Laws for liaison office registration of foreign company in Nepal is governed by Section 154 of Companies Act of Nepal.

3. Authority for Registration:

Office of Company Register (‘OCR”) is the governing authority to register a liaison office in Nepal.

Approval of government authority is not required however, Office of the Company Registrar (OCR) can ask for approval from relevant authority for registration of liaison office as per the nature of the business activities to be conducted.

4. Liaison Office Registration Process in Nepal

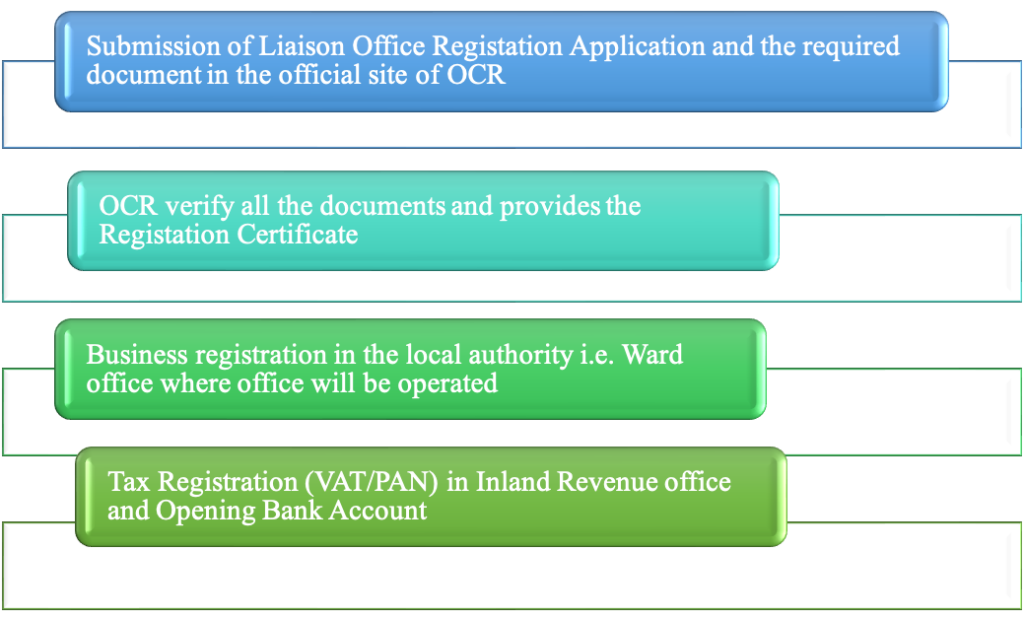

Below in the steps of the Liaison Office Registration Process in Nepal

Step 01: Submission of Liaison Office Registration Application and the required document in the official site of OCR.

Step 02: OCR verify all the documents and provides the Registration Certificate

Step 03: Business registration in the local authority i.e. Ward office where office will be operated

Tax Registration (VAT/PAN) in Inland Revenue office and Opening Bank Account

5. Business activities that Liaison office of Foreign Company can not allowed to do in Nepal:

- Liaison office registered in Nepal do not have separate legal status and legal personality, it is takes as the part of foreign company operating in Nepal.

- Liaison office of a foreign company registered in Nepal cannot be engaged in any kind of income generating activities in Nepal.

- No advertisement activities can be undertaken

6. Business activities that liaison office can conduct includes the following;

1. Market research and information gathering about the market trends, consumer behaviour,

2. Liaison office can provide information of the parent company’s product and service to the customers and suppliers,

3. Promotion of Parent Company

4. Facilitates trade between the Parent company and local business,

5. Coordinates with Agent in Nepal if appointed by foreign company.

6. Ensuring regulatory compliance and project monitoring, assist agents to import and use of products of foreign company without remuneration.

7. Time Required for registration Process of Liaison Office of Foreign Company in Nepal:

The time required for registration of a liaison office in Nepal tentatively takes 2 to 3 weeks.

8. Required Documents for registration of Liaison Office of Foreign Company in Nepal:

Required Documents are as follows:

| S.N. | Required Documents | Notarization |

| 1. | Memorandum of Association (MOA), Article of Association of foreign company and its Nepali Language Translation, Certificate of Registration | Required |

| 2. | Application for Liaison Office Registration | Not Required |

| 3. | Board Resolution of the Foreign Company to set up a liaison office | Not Required |

| 4. | Signed Copy of Company Profile | Not Required |

| 5. | Passport of all Directors of Company | Required |

| 6. | Citizenship of Nepalese Representative with authorized letter of appointment | Required |

| 7. | Proposed Plan of Liaison Office | Not required |

| 8. | Power of Attorney | Required |

| 10. | Resolution of all directors of foreign company that the documents and information are correct and accurate. | Not Required |

9. Post- Registration Compliance for Branch Office in Nepal :

Following are the post compliance requirement of branch office in Nepal:

- To be registered at local authority and the Inland Revenue Department for tax purpose to pay income tax in Nepal.

- Submit 3-month compliance document before OCR;

- Information to be updated to the concerned authority if any changes or amendment is made.

- Submission of the balance sheet of its parent company within 3 months from its preparation date.

- Appoint Auditor to prepare annual financial statement (audit report) of branch office

- Annual filling each year.

8. Difference between Branch Office and Liaison Office:

- Liaison Office are contact point for foreign company to communicate, coordinate establishing relationship with local business or parties but Branch office can do business activities.

- Liaison office are not permitted to generate income activities whereas branch office can earn.

- No any approval form government authority is required for liaison office establishment but for Branch office approvals are required as per nature of business.

- Liaison office cannot do any contract for business or transaction, advertisement and marketing for products of foreign company whereas branch office can do.

Please contact us today itself if you are in search of corporate lawyers for registration of liaison office in Nepal on +9779841933745 or email info@lawinpartners.com

Disclaimer: All contains available here are for general information purposes. A proper legal solution always depends on your particular circumstances thus seek advice from an attorney who can provide assurances of the information contained herein and interpretation of it. All liability with respect to actions taken on the basis of the site’s information is hereby expressly disclaimed.