Property Rights of NRN Citizens in Nepal

(This article will help you to know all the information about the legal provision of Property Rights of NRN Citizenship holder in Nepal).

1. Introduction of NRN Citizens:

NRNs are the people of Nepalese origin who reside outside Nepal.

As per FITTA ACT “Non-resident Nepali (NRN)” means a person holding the NRN identity card as per Nepali law.

As per NRN Act, “Non-resident Nepali (NRN)” means a foreign citizen of Nepalese origin, including Nepali citizens living abroad. Here,

- Foreign citizen of Nepalese origin means a person whose family lineage includes a Nepali citizen and who now holds citizenship in a non-SAARC country.

- Nepali citizen residing abroad means a Nepali citizen living abroad for at least two years, excluding those in SAARC countries, diplomatic missions, or studying abroad.

- Section 7(a) of the Nepal Citizenship Act 2063 provides for non-residential Nepalese citizenship.

- Person holding NRN Citizenship is allowed to enjoy social, economic and cultural rights in Nepal but not have right to enjoy political right in Nepal.

2. Relevant laws relating to Non-Resident Nepali:

The laws which govern Non-Resident Nepali are:

- Constitution of Nepal, 2072

- Non-Resident Nepali Act, 2064

- The National Civil Code, 2074

- Foreign Investment and Technology Transfer Act (FITTA), 2075

- Section 7(a) of Nepal Citizenship Act 2063

3. Sectors for investment to NRN Citizens:

- Share investment in foreign currency

- Re-investment of dividends derived from foreign currency

- Lease financing

- Investment in venture capital fund

- Securities investment through secondary market

- Investment in purchasing shares or assets of Nepali company

- Technology transfer

4.Sectors of Investment restriction to NRN Citizens:

As per the FITTA Act, the NRNs are restricted from making investment in Nepal which consists of following:

5.Property/land Acquiring by NRN Citizen in Nepal:

NRNs face restrictions on land acquisition, including limits on land type, maximum area owned, and other legal requirements. Also, NRNs are allowed to acquire land in Nepal through inheritance, gifts, purchases, or investments in specific sectors, but having limitation on the type and size of land they can own.

- By purchasing land/property in Nepal

- Inheritance of property by NRN in Nepal

- By investment in Nepal

1. By purchasing property in Nepal

NRNs are allowed to purchase a residential plot of land in different areas of Nepal, as per the NRN rules, not exceeding the following areas:

| S.N | Plot of Land (Maximum) | Areas for Purchase |

| a. | 2 Ropani | Inside Kathmandu Valley |

| b. | 8 Kattha | In municipalities of terai district |

| c. | 4 Ropani | In Municipalities of other districts except mentioned in (a) and (b) |

| d. | 1 Bigaha | Other areas of terai district except mentioned in (b). |

| e. | 10 Ropani | In other areas except mentioned in (a), (b), (c) and (d). |

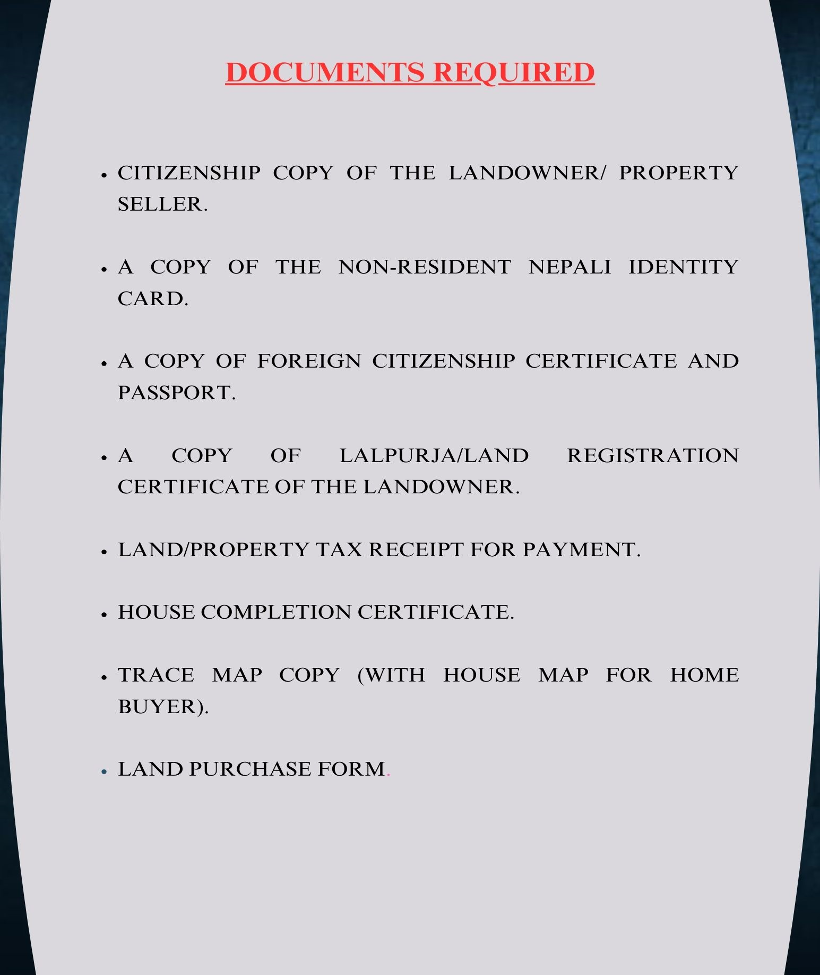

a.Required Documents for NRN for the purchase of Land/Property in Nepal

Non-Resident Nepali while purchasing the land or property of Nepal, must submit the following documents to the Ministry of Foreign Affairs;

An individual of Nepali origin intending to acquire land within Nepal, they shouldn’t own any land in their name and their family’s name. NRNs can acquire land for residential or commercial purposes within specific limitations set by the Nepal Rastra Bank and other regulatory bodies.

NRNs can purchase land/property in Nepal as per NRN Act 2064, and NRN Rules, 2065:

Step 1: NRN must retain NRN Card.

Step 2: Verification of land, confirming land boundaries, checking for legal issues pertaining from land and other.

Step 3: Authorization from the Ministry of Land Management or other related authority.

Step 4: Drafting of sale agreement specifying the necessary conditions of the purchase along with the payment schedule.

Step 5: Submit an application to the Secretary of the MoFA specifying the intended location, area, and fixed price for purchasing land in their or their family’s name.

Step 6: After certain inspection, MoFA gives the permission to purchase the land or other immovable property.

Step 7: The land registration office registers the land in the name of the foreign citizen of Nepali origin.

Step 8: Land revenue office issues the blue colored certificate to the buyer.

2. Inheritance of property by NRN in Nepal

NRNA Bylaws and Civil code grant NRN citizens equal rights in inheriting and owning property as Nepali citizens. It is indeed not necessary for foreign citizens of Nepalese origin to seek approval from Government of Nepal in order to inherit ancestral property from both Nepalese and foreign citizens of Nepalese origin. In regard to the inheritance of immovable property, a foreign citizen of Nepalese origin must have an NRN citizenship or NRN card.

The Property goes to the NRN legal heir in case of a deceased foreign citizen of Nepalese origin (having NRN Card) with property in Nepal. If not, then it goes according to the prevailing law.

3. By investment in Nepal

NRN citizen having NRN citizenship can invest in sectors like tourism or industry, potentially involving land acquisition, following government-set procedures and specific requirements. Non-resident Nepalis or Foreign Companies with over 50% NRN investment can invest their earnings abroad following foreign investment laws or Nepal Government notifications for NRN investments.

NRNs or Foreign Companies must invest through licensed Nepali banks or Financial Institutions, following prevailing financial transaction laws.

a. Conditions for NRN to make foreign investment in Nepal:

For NRNs aiming to invest in Nepal, these conditions are necessary:

| S.N | Conditions needed |

| 1. | Investing a minimum of NPR 50 million in company equity shares is required. |

| 2. | The intended business sector should not be listed as restricted in FITTA’s Negative List. |

| 3. | The intended business sector should align with the categories outlined in the Industrial Enterprises Act, 2020, as an “Industry”. |

b.Procedure of foreign investment by an NRN in Nepal:

The step wise process for foreign investment by NRN in Nepal is as follows;

Step 1: Register as an NRN Citizenship in CDO office or foreign Nepalese embassy or NRN ID in the Department of Foreign Employment (DoFE) for the NRN Card.

Step 2: NRN must obtain approval from Department of Industry (DoI) and Investment Board Nepal (IBN) for foreign investment in Nepal based on business purpose.

Step 3: In case of investment in new industry, incorporation of local company is needed.

Step 4: Open bank account and obtain Permanent Account Number (PAN) from Nepal Rastra Bank (NRB).

Step 5: Obtain necessary industry registration permission like environmental clearances.

Step 6: After completion of all the steps, NRN must obtain investment certificate from the bank as a proof of foreign investment in Nepal.

Step 7: Registration of foreign investment in Nepal with the Nepal Rastra Bank

Step 8: Information of foreign investment made in Nepal to be given to the Ministry of Foreign Affairs in the prescribed format.

Step 9: Information of foreign investment made in Nepal to be given to the Ministry of Foreign Affairs in the prescribed format.

Note: Labor Law of Nepal is taken in consideration while hiring Nepali citizens for employment and ensure minimum wage compliance.

6. Process of transfer of their property by NRN Citizenship holder of NRNs?

As like NRNs have right to own and inherit any movable or immovable property in Nepal, they also enjoy the same rights and facilities as Nepalese citizens for transfer of property in Nepal. Basically, NRNs can transfer their property in major two ways as;

- By Selling

- By donation

1. By Selling

Unless permitted by the Government of Nepal, if a foreigner inherits or acquires a share in Nepali property, they can’t register it in their name or derive income from it.

NRNs can sell land similarly to Nepali citizens, but the NRN Department of MOFA doesn’t approve repatriating money from these sales. Nepal Rastra Bank (NRB) also doesn’t authorize repatriation of such funds. However, this income can be used within Nepal instead of sending it abroad.

a.Procedure of transferring property by NRN by selling in Nepal:

The step wise process for property transfer by selling would be as below;

Step 1: Preparation of documents.

Step 2: Drafting of sale agreement detailing sale terms and conditions.

Step 3: Obtain no objection certificate (NOC) to confirm property’s legal status also property title documents shall be verified for clarity.

Step 4: Signing of the detailed sale agreement with the buyer.

Step 5: Preparation of sale deed transferring ownership from seller (NRN) to the buyer along with the signature of the seller (NRN), buyer and the witnesses.

Step 6: Registration of the sale deed at the local Land Revenue Office.

Step 7: Required tax amount, fees and other stamp duty shall be paid as per Nepali laws based on property value.

Step 8: After the completion of the legal procedure, property is transferred in the name of the buyer where the NRN ownership rights are transferred to the buyer and the buyer becomes the new owner of the property.

Step 9: Final step would be to notify the related authority about the change of ownership of the property and update land records accordingly.

2. By Donation or Gift

- NRNs donate their property for religious, social or any other purposes as his/her wish intending not to make any profit from those transfer ownership.

- NRNs as a love and affection grant their property to their close ones or relatives or friends as a gift and not returnable to them.

7. The things to be considered for NRNs in terms of Tax and Investment in Nepal?

- Nepal’s tax law distinguishes between Resident and Non-Resident tax payers.

- Residents declare global income and pay taxes accordingly, while Non-Residents declare and pay taxes solely on their Nepal-based earnings.

- NRNs pay taxes in Nepal as Non-Resident tax payers on their Nepalese income.

8.Can individuals of Nepali origin sell their property and transfer the proceeds overseas?

- Yes, the individuals of Nepali origin can sell their property and take the money back to foreign land as prescribed in the prevailing law of the country.

Please contact us today if you are in search of Property Lawyers in Nepal for cases in Nepal on +9779841933745 or email info@lawinpartners.com

Disclaimer: All contains available here are for general information purposes. A proper legal solution always depends on your particular circumstances thus seek advice from an attorney who can provide assurances of the information contained herein and interpretation of it. All liability with respect to actions taken on the basis of the site’s information is hereby expressly disclaimed.